In the first chapter, we discussed planning and assembling the team. Now we can move on to figuring out how to pay for it.

Even with the largest commercial projects, you always begin with a “projected” budget. Or, what most folks would call a guess. No matter how vague, this is where it always begins. In many cases, you can find online references that can give you industry estimates of cost per square foot. I’ve never used that and have just worked from the base of my own experience, which has actually gotten me into a lot of hot water over the years, but that’s another story. Next, you need to figure out how much cash you’ll need upfront and how much you’ll be financing. Commercial buildings are all about the ROI (return on investment), so a good financing plan is critical. Yes, you can pay cash, but for investment purposes, that’s not advisable.

The best financing that’s available for commercial buildings relies on one big question: do you plan to occupy the property? We hear that every day in residential real estate, and yes, it applies to commercial as well. You’ve seen iconic buildings like Transamerica, SalesForce, etc. Their companies don’t occupy the entire building, but they certainly occupy some of the suites and they rent the rest out to offset the expense and create a return. But, by and large, when a sizeable commercial project goes up, you bet the owner/client will occupy that property. First, the financing is easier. Banks are a bit more at ease when they know this is an office space that your own business venture will operate from. Second, they’re so much more at ease that the down payment is lower. You’ll generally pay around 30% down or more when building without owner-occupancy. You can get in for as little as 20% down if you move into it.

The next step is to take the whole concept to a few lenders and get their buy-in. For commercial financing, you talk to a commercial lender, and those can be easily found at your local bank. One of the first tips I give any real estate investor is to develop a strong relationship with a local banker. In both business and real estate investments, this will prove invaluable. Over the years I have worked with both Extraco Banks and National United and having done so they’re already familiar with my work and how I operate. They also have my financial statements and tax returns on file so when I need money for any project it’s just an email and a quick meeting away. But this is bigger than anything I’ve done, and every bank has its own likes and dislikes. And while they’ve been a solid partner for years, Extraco stepped off this one early. While this was a surprise, it wasn’t, and only because you have to know there will always be surprises. National United in Killeen, under the savvy leadership of Ryan Shahan, VP, was thrilled with the concept and issued a preliminary approval within days. I now have my financing partner, but final approval won’t be issued until we’ve completed the plans, the budget, the appraisal, and after I’ve submitted updated financial statements. They’ll also want to know that I have the capital available for the down payment. So, about that…

With financing in the works and looking promising, I now turn my attention to freeing up $350,000. Another interesting issue when building commercial is the level of investment you have to make upfront before you even know if you’ll be able to do it. You can get away with holding the land off the market for as long as 6-12 months, but you’ll still be risking a sizeable option fee. Then, you need to make the full investment in your team, your plans, and all the engineering and testing that’s required to start. So, don’t ever go into a commercial project and think you won’t need the down payment until the end – you need it to start. Your cash goes first and goes before you even know if your dream will ever materialize. With higher risks come the greatest of rewards.

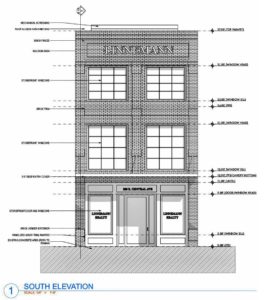

We bought the land and closed on it, and we’ve now completed the architecture and engineering required to get a building permit. We’re $160,000 into the project and haven’t turned a shovel of dirt.

But I digress. Let’s talk about accessing the cash we’ll need. When accessing cash, you always need to think about the opportunity cost. Opportunity cost is the loss you take when using this cash for something and not using it for something else. It’s the projected income you could make with that cash in another use. You always want to be sure to use your investment capital for the highest-return investment you can, otherwise, your opportunity cost can be greater than your actual return and you’ve just lost money. In my case, I’ve decided to liquidate a good portion of our rental portfolio.

Over the years we’ve acquired a respectable inventory of small, single-family homes as rentals. Whether through MLS or at auction, we would generally pay about 50 cents on the dollar in cash, then about 25 cents on the dollar in rehab. Once complete, we would work with those same local commercial lenders to cash-out refinance the property on a 15 or 20-year note and then make it a rental. I’ve always prioritized patience and timing with real estate and haven’t bought anything in about 4 years because the market is too solid. But, that being said, this is the perfect time to sell. The one issue we would face would be capital gains tax. Given the manner in which we purchased and refinanced these properties, the balances on the notes are far greater than the depreciated balances for tax purposes. In English, that means we would get hammered by our friends at the IRS because we would be paying taxes on an amount greater than the actual net from the sale.

This is when you call Nancy S. Carothers who sets up a magical process known as a “1031 Exchange”, or in our case, a “1031 Reverse Improvement Exchange.” In a 1031, the proceeds from the investments you’re selling go straight into a trust account managed by your 1031 attorney. From that account, they move the funds into a like-kind property that you’re buying, and in doing so all of your tax liability is deferred until such a time as you sell that new acquisition. So: sell a property and buy another one with the proceeds but move the funds through a 1031 and you pay no capital gains tax. Like I said, it’s magical.

Nancy can’t do it alone, though, as she and any 1031 wizard will still need the counsel of your tax preparer. In this case, we lean on Lillie Aguero & Associates who have handled our tax accounting and bookkeeping for years now. It’s their job to run the figures on the depreciated balances for each property so we know how much of a tax deferment to register. The 1031 also needs its own bank account, a trust account that you specifically cannot touch. Nancy, via the 1031 trust account with National United, will then be responsible for paying any and all bills that get presented against the account until the funds are entirely depleted or the 6-month period allowed for any 1031 exchange elapses.

Nancy can’t do it alone, though, as she and any 1031 wizard will still need the counsel of your tax preparer. In this case, we lean on Lillie Aguero & Associates who have handled our tax accounting and bookkeeping for years now. It’s their job to run the figures on the depreciated balances for each property so we know how much of a tax deferment to register. The 1031 also needs its own bank account, a trust account that you specifically cannot touch. Nancy, via the 1031 trust account with National United, will then be responsible for paying any and all bills that get presented against the account until the funds are entirely depleted or the 6-month period allowed for any 1031 exchange elapses.

I never said this would be simple. Sidebar: my degree is in finance, and I love this stuff.

But I digress. Let’s get back to the matter at hand: unloading some rental property. With that, we wound up listing 11 properties for sale out of our rental portfolio. Given the price range of these homes, the fact that we’ve maintained them well over the years, and that the market is red hot, they’ve all sold as of this writing, at or above the listed price. The funds went through the 1031 account which purchased the lot and paid for all the architecture and engineering work, along with some ground clearing. At the 6-month mark the account closed and the remaining funds were transferred to us personally. With that, we actually freed up close to $400,000 which should prove to be ample cash for the balance of this project. The opportunity cost here is the return we were enjoying from the rental homes. We need to make sure the return we get on the new building far exceeds all of those houses put together. I’m confident we’ve made the right decision, but time will certainly tell.

So what’s next? We’ve got preliminary financing approval and all the cash we need to make this project happen. As of this writing, the plans have just been finalized so we can start interviewing subcontractors and reviewing proposals. Once the subs have been selected we’ll have our final budget, and with that, we can go back to our lender for final approval. That will take about 4-5 weeks as they will need to order a plans and specs appraisal, which is a costly, time-consuming process. It’s also a daunting hurdle because if your appraisal comes in short then so does your loan amount.

We’ll slay that dragon another day. For now, let’s celebrate the success of the question of finance. To sum up, we’ve got preliminary loan approval and we freed up all the cash we need for this project without writing a check out of our personal savings or paying any capital gains tax. That, my friends, is a good day in the world of real estate finance.

The team is assembled, the financing in place, now let’s get these plans done. That will be covered in Chapter 3.

M